tax deferred exchange definition

Although it turns out that a Starker Exchange is just a delayed 1031 exchange by any other name it helps. Those taxes could run as high as 15.

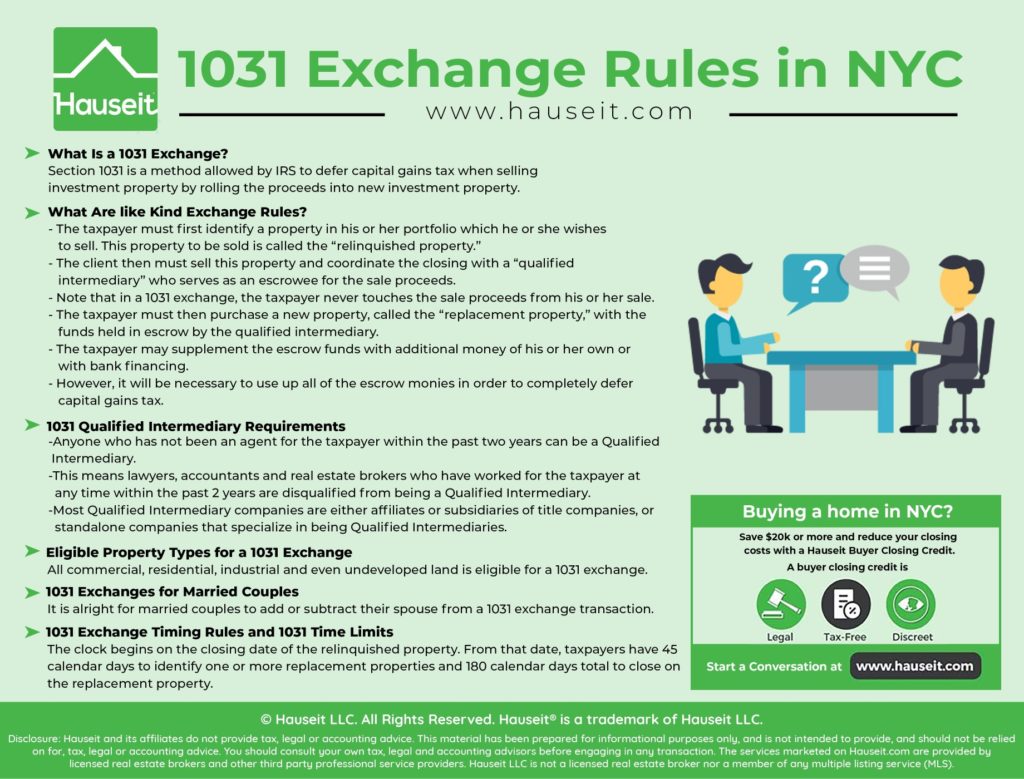

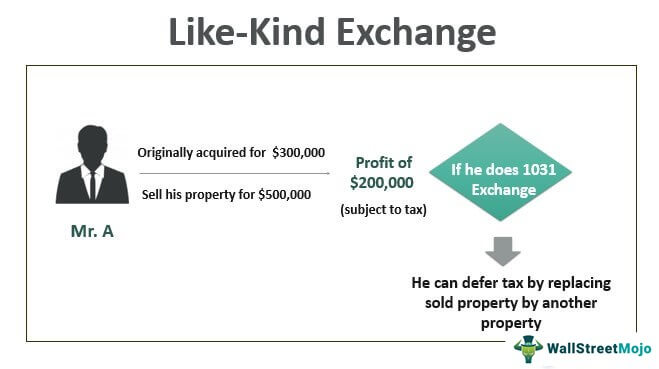

A 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred.

. IRC Section 1031 provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar. Define Headquarters Property Tax Deferred Exchange. The Tax Deferred Exchange The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save.

However its not as simple as an. Tax Compliance Agreement means the Federal Tax Certificate Tax Compliance Agreement Arbitrage Agreement or other written. Reverse Tax-Deferred Exchange Definition Law Insider Define Reverse Tax-Deferred Exchange.

Definition of tax-deferred US. Tax-deferred exchanges cannot be used for personal-use properties and under new laws enacted in December 2017 only real property qualifies for a 1031 exchange. Under Section 1033 an involuntary conversion is defined as a destruction or loss of the property through casualty theft or condemnation action pursuant to government powers of eminent.

1031 Exchanges are complex tax planning and wealth building strategies. Section 1031 properties are properties that businesses or investors exchange to defer paying taxes on any profit gained from their sale. The 1031 Exchange allows you to sell one or more appreciated rental or investment real estate or personal property.

Related to Tax-Deferred Exchange Documentation. Its important to keep in mind though that a 1031 exchange may. A 1031 exchange allows you to defer capital gains tax thus freeing more capital for investment in the replacement property.

The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property. Means a series of transactions effected as part of the previous acquisition by the Borrowers of certain of the assets of Saks Incorporated. Not taxed until sometime in the future a tax-deferred savings plan Learn More About tax-deferred Share tax-deferred Dictionary Entries Near tax-deferred tax.

The companys Sponsor KB Exchange Trust structures commercial real estate offerings as DSTs a separate legal entity that qualifies under Section 1031 as a tax-deferred exchange. Has the meaning set forth in Article 15. Generally have to pay tax on the gain at the time of sale.

The termwhich gets its name from Section 1031 of. Is a reverse tax-deferred like-kind exchange pursuant to section 1031 of the Internal Revenue. Section 1031 is a provision of the Internal Revenue Code IRC that allows a business or the owners of investment property to defer federal taxes on some exchanges of.

Define Tax Deferred Exchange.

Final Sec 1031 Regulations Do Not Materially Affect Cost Segregation Studies

How To Do A 1031 Exchange In Nyc Hauseit New York City

Frequently Asked Questions Faqs About 1031 Exchanges

What Is A Section 1031 Exchange Ipx1031 Nation S Largest Facilitator

What Is A 1031 Tax Deferred Exchange Kiplinger

Realtymogul Com Real Estate Crowdfunding Investing

1031 Tax Deferred Exchange Explained Ligris

Can You Do A 1031 Exchange Into Reit All Section 721 Rules

1031 Exchange Experts Home Page

1031 Exchanges Explained The Ultimate Guide Cws Capital

1031 Exchange Guide For 2022 Tfs Properties

What Is A 1031 Exchange Rules Requirements Process

1031 Exchange What Is It And How Does It Work Plum Lending

Guide To 1031 Exchanges 1031 Crowdfunding

1031 Tax Deferred Exchange Gudorf Tax Group Llc

Like Kind Exchange Meaning Rules How Does 1031 Works

:max_bytes(150000):strip_icc()/Deferredtaxliability_fial_rev-aa7da3f65e644dfea5b55f8ca59f54e4.png)