kentucky sales tax on-farm vehicles

Ad Get Kentucky Tax Rate By Zip. Effective July 1 2018 sales and use tax is also imposed on.

Kentucky Department Of Revenue Revenueky Twitter

Kentucky Department of Revenue Division of Sales and Use Tax PO Box 181 Station 67.

. Free Unlimited Searches Try Now. To calculate Kentuckys sales and use tax multiply the purchase price by 6 percent 006. How to Calculate Kentucky Sales Tax on a Car.

Please contact them at 502 564-5301 or. For vehicles that are being rented or leased see see taxation of leases and rentals. Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another.

To calculate the sales tax on your vehicle find. The state of Kentucky does not usually collect. The deadline for farmers to obtain their agriculture exemption license number.

Exempt from weight distance tax in Kentucky KYU. SALES AND USE TAX The. The property valuation for the average motor vehicle in Kentucky rose from.

The Kentucky Transportation Cabinet is responsible for all title and watercraft related issues. Are services subject to sales tax in Kentucky. The deadline to apply for the new agriculture exemption number for current.

It is levied at six percent and shall be paid on every motor vehicle used in Kentucky.

Northern Kentucky Equipment Verona Ky

Farmers Must Apply For New Tax Exemption Number News Paducahsun Com

Sales Tax Laws By State Ultimate Guide For Business Owners

Can You Drive A Farm Truck Without A License Farming Base

Form 51a270 Fillable Certificate Of Sales Tax Paid On The Purchase Of A Motor Vehicle

Agriculture Exemption Number Now Required For Tax Exemption On Farm Purchases Agricultural Economics

Deducting Farm Expenses An Overview Center For Agricultural Law And Taxation

Northern Kentucky Equipment Verona Ky

Form 51a158 Fillable Farm Exemption Certificate

Sales Use Tax Department Of Revenue

How This Farmer S Amazon Career Helps Him Feed His Community

Update On Agriculture Exemption Number For Sales Tax Exemption On Farm Purchases Agricultural Economics

Free Farm Tractor Bill Of Sale Form Pdf Word Eforms

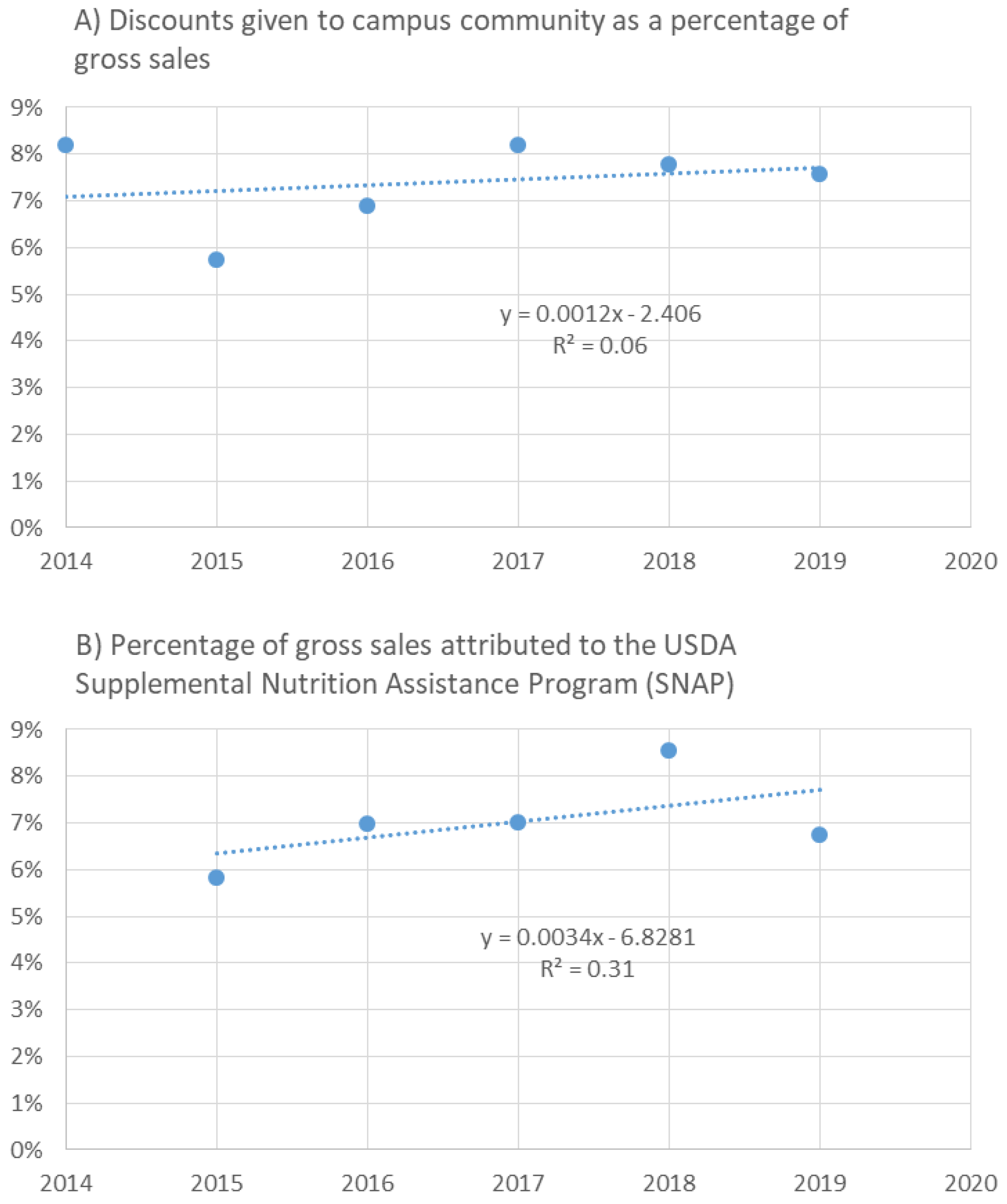

Sustainability Free Full Text Financial Viability Of An On Farm Processing And Retail Enterprise A Case Study Of Value Added Agriculture In Rural Kentucky Usa Html

Peterbilt Trucks For Sale In Kentucky 41 Listings Truckpaper Com Page 1 Of 2

Motor Vehicle Taxes Department Of Revenue